The formula for residual income would be: RI Net Income - Equity Charge. Let’s assume that Company X makes 55,000 per year. Thank you for reading CFI’s guide to Residual Income. To calculate residual income, subtract the Equity Charge from the company’s net income. If one demonstrates a high RI, his loan is more likely to be approved than for an individual with a low RI. It helps the institutions determine whether an individual is making enough money to cater for his expenses and secure an additional loan. Residual income is an important metric because it is one of the figures that banks and lenders look at before approving loans. Essentially, it is the amount of money that is left over after making the necessary payments. It refers to any excess income that an individual holds after paying all outstanding debts, such as mortgages and car loans.įor example, assume that worker A earns a salary of $4,000 but faces monthly mortgage payments and car loans that add up to $800 and $700, respectively. In the context of personal finance, residual income is another term for discretionary income. The equity charge is computed by multiplying the cost of equity and the company’s equity capital. Simply put, the residual income is the net profit that’s been altered depending on the cost of equity. RI Formula RI = Net Income – Equity Charge The RI helps company owners measure economic profit, which is the net profit after subtracting opportunity costs incurred in all sources of capital.

In such a case, the company is assessed based on the sum of its book value, as well as the present value of anticipated residual incomes. When it comes to equity, residual income is used to approximate the intrinsic value of a company’s shares. They include items like cash, accounts receivable, inventory, and fixed assets, among others. Average operating assets are the kind of resources required to sustain the company’s operations.Required rate of return is the minimum amount of return that a company is willing to accept from a given investment.

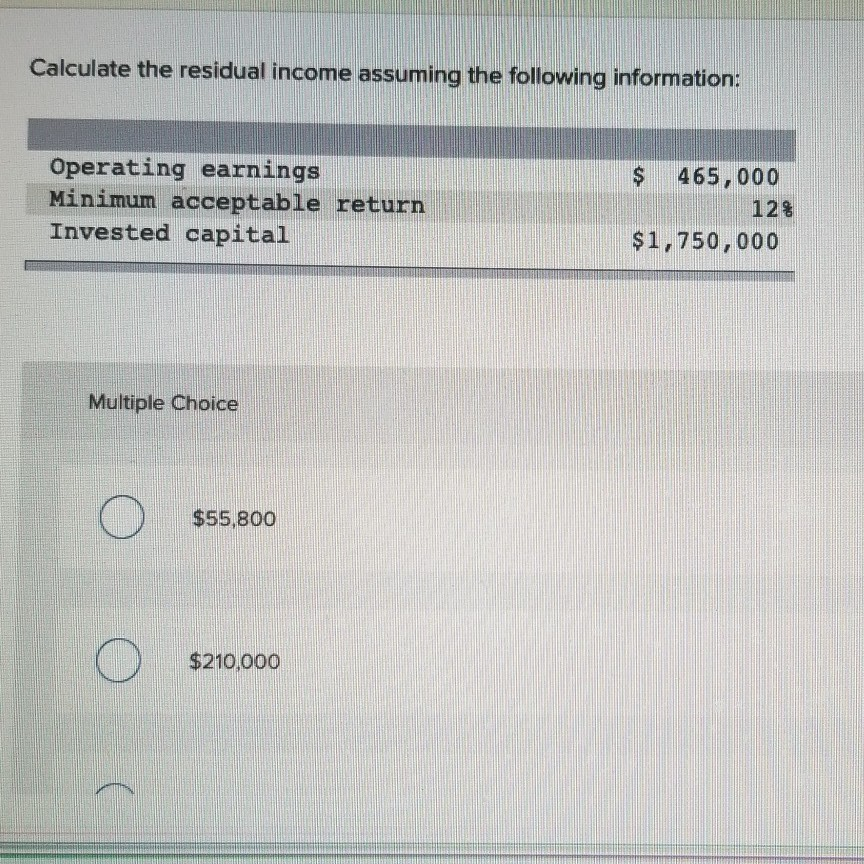

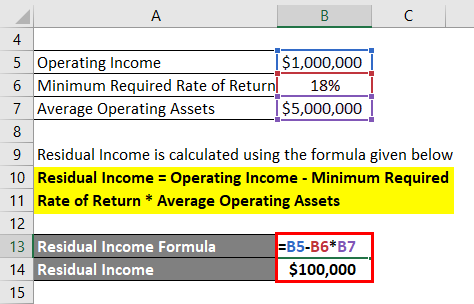

Controllable margin, which is also known as segment margin, refers to the project’s revenue less expenses.RI Formula RI = Controllable Margin – Average of Operating Assets * Required Rate of Return On the contrary, a negative RI means it failed to meet the projected rate of return. When there’s a positive RI, it means the company exceeded its minimal rate of return. However, in the context of equity valuation, residual income refers to the net income after accounting for all the stockholders’ opportunity cost in generating that income.Ĭalculating the residual income enables companies to allocate resources among investments in a more efficient manner. When looking at corporate finance, residual income is any excess that an investment earns relative to the opportunity cost of capital that was used. such as if the value of some of the investment declines.Residual income (RI) can mean different things depending on the context. However, residual value isn't a guarantee more expenses or fees can change the RV, and all sorts of other things can change the value of the remaining investment in a fund. RVPI is an excellent multiple to use when guessing how much more an investment might pay out to LPs. To better compare to your other investments, use the fund's net IRR. RVPI is not time-aware, you might be looking at marks from a year-old fund, or seven years into the fund. TVPI also includes all distributions made to investors, further isolated in the DPI multiple, or Distributions to Paid-In Capital ratio. RVPI is related to the TVPI multiple or Total Value to Paid-In Capital.

It shows how much the fund has yet to pay out to Limited Partners versus how much those investors have paid into a fund. RVPI is the Residual Value to Paid-In Capital multiple. Called/Paid-In Capital - called money in the fund, or money paid-in by LPs.Īssuming all investors started simultaneously under the same terms, the math will be equivalent whether you run the numbers for the whole fund or a single pro-rated investment.Residual Value - the estimated value of remaining investments and cash in the funds owed to LPs net of fees, expenses, carried interest, promote, or other costs.4 RVPI in Investments Using the RVPI Calculatorīefore you can use the RVPI calculator, gather two inputs:

0 kommentar(er)

0 kommentar(er)